Long TI Fluid Systems (LON: TIFS)

By James Shi, Richard McGrail, Abraham van Zanten, and Ethan Kaplan

TI Fluid Systems (LON: TIFS)

Share Price: 120.17 GBP Market Cap: 625M GBP

James Shi, Richard McGrail, Abraham van Zanten, and Ethan Kaplan

Summary

○ While TIFS’ stock price has historically correlated with the downturn of the automotive supplier market, the company’s EV-compatible product offerings uniquely position them to benefit from the electrification trend with significant revenue growth and margin expansion.

○ TIFS is the dominant market player in their niche with a long-lasting relationship with manufacturers. Their contracts are sticky and long-term, which protects their cash flow consistency.

○ TIFS consistently generates better operational and financial metrics than its competitors.

○ From a valuation standpoint, TIFS is both relatively and intrinsically undervalued. Our DCF and Comparable Analysis below demonstrate significant upside.

Company Overview

TI Fluid Systems plc (TIFS) is a leading global manufacturer of automotive fluid storage, carrying, and delivery systems. Their production is focused on light passenger vehicles where they operate two segments: Fluid Carrying Systems (FCS) and Fuel Tank and Delivery Systems (FTDS). FCS includes fuel lines, brake lines, and thermal management solutions with a strategic focus on battery electric vehicles (BEVs). FTDS includes fuel tanks and pumps focused on traditional internal combustion engines (ICE) and hybrid electric vehicles (HEVs). TIFS’ main customers are traditional OEM automotive manufacturers with Volkswagen, Mercedes-Benz, Hyundai, and Ford being among its largest customers. Currently, FCS contributes 54% to the revenue and FTDS contributes 46%. Additionally, their FCS segment has higher operating margins at 9.0% versus FTDS at 7.9%.

Thesis 1: Pivot to EVs will Foster Revenue Growth and Margin Expansion

Despite macroeconomic headwinds such as supply chain disruptions and consumer demand cooldowns, major automobile manufacturers are still making the transition to electrify their fleets. Over the past few years, BEV production has significantly increased from 2.7% of total car production in 2019 to 13.1% in the first half of 2022. This electrification trend is projected to continue. By 2030, upwards of 40% of cars produced will be electric. For automotive suppliers, this electrification trend means increased capex and compressed margins amidst a historically high-interest rate environment. Unsurprisingly, this, along with the aforementioned macro headwinds, has caused the sector to decline roughly 40% from its highs. While the market has lumped TIFS together with its automotive peers, trading at a 0.92 correlation to an industry ETF (FSAVX), we believe that TIFS is positioned advantageously in the automotive supply chain during this transition period.

BEV’s electric motors and large batteries require more thermal management solutions than conventional ICE vehicles. TIFS’ FCS segment is already well positioned to capture this demand due to their thermal management focus. In 2020, TIFS averaged revenue of €135 per BEV they supplied parts to, which is 2.4x of revenue per ICE at €56. In the future, there is more room for growth on a content-per-vehicle basis. While TIFS’ total potential CPV for ICE is barely around €200, BEV doubles the number at €400 and HEV at €700 due to the more complex structure of the powertrain. Furthermore, the entirety of the company’s sales for BEVs falls under the FCS segment which has had significantly higher margins than their ICE-centric FTDS segment. With FCS operating margins 10% greater than FTDS margins, rising BEV production will lead to not only large revenue growth but substantial margin expansion.

TIFS has ample opportunities to further increase their CPV in BEVs through emerging thermal technologies like CO2 heat pumps. Currently, most BEVs rely on electric heating systems. These systems reduce 40% of BEV range. However, the TIFS CO2-based heat pump can perform equally with a reduction of only 15-20% battery. IHS estimates that non-electric heat pump penetration in BEVs will increase from 33% in 2022 to 70% in 2028. To date, TIFS is the only manufacturer of CO2 automotive heat pumps. Current alternatives are based on refrigerant R1234yf which is roughly 5% less efficient than CO2 automotive heat pumps. Since R1234yf is a 1000x more potent greenhouse gas compared to CO2, government regulators are looking to phase out R1234yf in favor of CO2 pumps. Considering BEV customer base’s emphasis on range and environmental friendliness, CO2 heat pumps are best positioned to be the preferred method of BEV cabin thermal management systems.

Thesis 2: TIFS’ Strong Customer Relationship and Sustainable Business Model Allows Them to Compete Effectively

TIFS leverages its global presence and long-lasting OEM relationships to maintain and expand its footprint. There are 107 plants across 29 countries with approximately 25,600 employees. All of those plants are in close proximity to the OEM manufacturing plants, with many directly co-located in the same location. This symbiotic relationship creates a sustainable moat and mutually beneficial relationship between TIFS and OEMs. This strategy has proven to be effective. For over a decade, TIFS has controlled 30% of the brake and fuel line market globally with its nearest competitor occupying less than 15% of the market. They supply 10 out the 20 top-selling nameplates in China, 12 out of 20 in North America, and 19 out of 20 in Europe. The strong relationship with the OEMs not only means lower overhead and customer acquisition cost but also allows TIFS to defend its market position. TIFS has a specifically strong presence in China. Traditionally, China does not allow foreign companies to obtain full ownership of Chinese subsidiaries. However, TIFS has a 100% owned subsidiary in China and 18 manufacturing plants. Historically speaking, domestic businesses in China have precedence over international firms in state, financial, and regulatory support. This allows TIFS to operate more nimbly without sacrificing access to the fast-growing Chinese auto market.

TIFS has strong customer stickiness. It is not only costly but also time-consuming for OEMs to switch to a new supplier. On average, it takes two to three years for an OEM just to switch the FCS because of the long testing and optimization stage. Once an OEM selects its partner, it is unlikely for the relationship to change. They also have a diverse revenue stream with 38% of revenue in Europe, 36% in Asia, 24% in North America, and 2% in Latin America. Their largest single customer, Volkswagen, contributes only 14% of the total revenue. This decentralized revenue base facilities revenue consistency and eliminates customer concentration risk.

TIFS has low capex at around 3% due to the existing facility capacity. By leveraging their existing nylon and lightweight technical know-how, TIFS is able to target key OEMs with thermal management systems for BEVs and HEVs despite spending only 2% - 3% on R&D. The low fixed cost (<15%) model allows TIFS to weather better under low-demand market conditions.

Aside from 2020 (net income negative), the vertical integration of TIFS has created a profitable business model in a hyper-competitive industry. TIFS’ closest competitor is Cooper Standard, which produces sealing, fuel and brake lines, fluid transfer hoses, and anti-vibration systems. Even now, with macroeconomic headwinds depressing margins, TIFS remains 8.06x more profitable than its competitors based on adjusted EBITDA. While one of their main competitors, Cooper Standard, achieves a lowly 0.67% adjusted EBITDA margin, TIFS stands much stronger at 5.4%. Even during recessionary periods, a large margin of safety, the previously mentioned low capex, and low fixed cost prove its resiliency and the company’s strong competitive advantage and superior capital allocation abilities.

In the long run, large margins will provide more capital availability, less exposure to macroeconomic headwinds, and support larger-scale production. A large proportion of other manufacturers are small-scale, local, and continuing to lose market share to global production players like TIFS. In times of economic crisis, small-scale enterprises also have historically failed. During the great recession, over 20% of SBA loans defaulted. We can expect a similar, if not further exacerbated, impact on local producers of FCS. However, only TIFS is financially able to handle the expansion to such areas in times of uncertainty due to their inflated margins. Thus, TIFS has the unique opportunity to capitalize on failing players in a global market downturn.

The OEMs have largely recognized TIFS as the superior supplier for their new EVs. In the past 5 years, they had explosive growth in their BEV business wins. In 2017, TIFS only won 1% of the BEV business. This number steadily increased to 47% in 2020. Furthermore, automakers seem to be going to TIFS with their BEV contracts. Out of the 46 BEV launches between 2020-2022, 31 (67%) contained TIFS content. TIFS has many existing and planned collaborations with OEMs in new technologies for HEVs and BEVs. TIFS is also aggressively establishing relationships with new OEM entrants in the BEV space, especially in China. While currently TIFS has a relatively low market share in the HEV space (Top 6), they are poised to grow. This is because Japanese OEMs (Toyota, Nissan, and Honda) currently dominate the HEV space. However, the balance would shift greatly into China and Europe by 2028 and TIFS will be best positioned to capture the growth due to its relationship with legacy OEMs.

Valuation

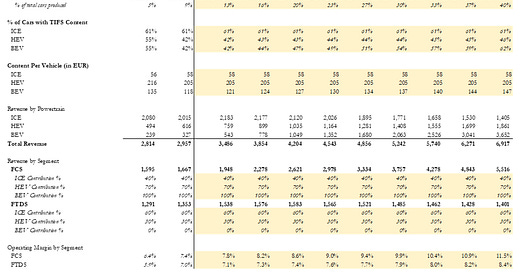

We synthesized our research above to generate an operating model and subsequent DCF. Unfortunately, likely due to its small-cap nature, the firm does not report all the essential KPIs we believe are necessary to build a complete top-down operating model. We attempted to reach out to the company’s IR department to gather key information, such as the number of cars by powertrain that contains their content, but received no response. Based on various company filings, our conservative estimates for TIFS’ market penetration by powertrain and the company’s reported CPV per vehicle produced the following operating model:

Translating these projections into a discounted cash flow model, we estimate an implied share price of 200 GBP, representing over 60% potential upside. On a relative basis, TIFS trades below its automotive supplier peers:

Even though the broad automotive supplier market faces a future of compressed margins and increased capex as the EV transition accelerates, they still trade at higher valuations to TIFS.

Conclusion

Overall, we see TIFS as trading significantly below both its relative and intrinsic value. Due to its small market capitalization and niche product offering, TIFS has been unfairly lumped into the overall downward market trend in the automotive supply industry. Coupled with their superior positioning in the electrification pivot and dominant market position, we believe that this presents a buying opportunity with strong upside potential and margin of safety.

Contact Information

James Shi: ys866@georgetown.edu

Richard McGrail: rdm119@georgetown.edu

Abraham van Zanten: agv38@georgetown.edu

Ethan Kaplan: esk59@georgetown.edu

Lithium batteries are not the way of the future. Cobalt is finite, lithium battery lifespan is far too short , , they are extremely costly to replace and there is not enough infrastructure in place to recycle them. The motors will need extreme advancements to endure climates and environmental hazrds. While many are piling onto the EV bandwagon, no country on Earth is currently setup to provide enough energy to meet demand of the ever increasing Green initiatives forced upon citizens worldwide. The horse must come before the carriage.