Introduction

Individuals, businesses, and governments all rely on data to drive decision making. The world has become reliant on more and new forms of data, driving exponential growth in the volume of data. Much of this new data comes from human activity on the internet. However, there is a stark lack of data on the activities of humans on Earth. Planet aims to solve this problem.

Earth Observation Industry Overview

Before we dive into Planet, let’s look at earth observation more broadly.

Earth observation (“EO”) is simply the use of sensors to measure the earth from above. EO firms earn money selling geospatial data (data with a location attached) obtained from imagery.

The first image from space was taken in 1946 by a camera strapped to a confiscated German V-2 rocket. Since then, satellite capabilities have transformed, enabling operators to capture high-resolution imagery daily and transmit the images back to Earth via radio waves.

Historically, long, expensive development cycles and high launch costs limited satellite EO to governments (for defense, intelligence, and research). In 1993, this changed when the Department of Commerce granted WorldView Imaging Corporation (later DigitalGlobe, now Maxar) the first license for a private enterprise to build and operate a commercial satellite EO system.

Over the following decade(s), satellite development followed a pattern: build larger satellites to take higher resolution images, with lower revisit times. This is because operators were incentivized to cater to the needs of the largest buyers, governments.

Around a decade ago, the development model shifted. EO start-ups (Planet the leader) approached the market from a new perspective: build smaller, cheaper satellites that offered comparable performance to the traditional large buses (a bus is the main body of a satellite that contains the scientific instruments) at a fraction of the cost. Two major changes fueled this shift:

- ~1,000x increase in cost-performance of smaller satellites, driven by the proliferation of advanced commercial off-the-shelf (“COTS”) electronics.

- ~4x decline in launch costs, driven by SpaceX’s invention of the reusable rocket.

These improvements enabled satellite operators to tolerate the one thing they previously could not: failure – a necessary ingredient for innovation. Planet embraced this novel concept of failure and adopted a new form of satellite development, dubbed “agile aerospace” (after agile software development). The new approach encourages frequent iteration and in-space experimentation to develop innovative new applications. So, where does the industry go from here?

Broadly speaking, the costs to experiment in EO are declining while the commercial opportunity is growing, setting the stage for discovery of the true market opportunity. Agile aerospace permanently accelerates the pace of innovation, which will, over time, lead to mass commercialization of satellite imagery. Satellite imagery is already more widely used than ever, but it remains far from mass adoption. Why? Because of a lack of accessibility – most use cases require geospatial experts to interpret the data. Planet intends to address this problem by “software-izing” its raw data, thereby making it accessible to ordinary users.

Looking ahead, I find it a simple exercise to conceive of a world where a daily, global dataset of earth imagery accompanied by industry-specific analytics is valuable to thousands of businesses. Planet, with its unmatched constellation and platform, is best positioned to lead this market.

What is Planet?

Planet Labs is the second largest commercial satellite constellation operator behind SpaceX (Starlink). The Company has designed, built, and launched over 450 satellites and currently operates over 200 satellites orbiting the Earth every 90 minutes. These satellites take millions of images daily, covering 300 million square kilometers (2x the Earth’s landmass) every day.

Planet generates revenue by selling licenses to its satellite data via annual subscriptions (average length of ~2 years) to its cloud-based platform. Subscription pricing depends on coverage area, the number of users, and the depth of insight (how far up the software stack).

The company’s customers are primarily federal governments, civil governments, agricultural firms, mapping firms, and to a lesser extent, firms across the insurance and energy industries.

Planet operates two constellations supporting two complementary offerings:

1. Dove constellation produces a daily line-scan covering every point on Earth’s landmass. It is the only company to offer a comprehensive, global dataset at a daily cadence.

a. Dove satellites cost ~$300k (about half materials, half labor and launch) and serve a useful life of ~3 years. The payback period is estimated to be 3-6 months.

2. SkySat constellation provides satellite tasking services (similar to traditional EO offerings), from which customers can obtain higher resolution imagery of a specific area.

a. Planet is replacing this constellation with next-generation satellites (called Pelicans) beginning in 2023.

b. Pelicans cost around $4 – 4.5 million with a useful life of ~5 years. Management anticipates the Pelican constellation buildout will require capex in the high single-digits percent of revenue over the next few years. Based on management’s discussion of customer eagerness for Pelican, I believe the satellites will have similarly attractive payback periods.

Planet is a fundamentally mission-driven company. The founders (two of three remain at the company; the third left in 2015 for venture capital) started with an idea, executed the initial idea (build a constellation capable of imaging the whole Earth daily), and are now exploring the commercial opportunities enabled through the idea.

Further, it’s vital to understand that disruption is in the company’s DNA. The initial idea was impossible to execute under a legacy EO model. To make the mission economically viable, the founders threw out the traditional industry playbook: sell high margin images, taken from high-resolution satellites, to high-paying governments on a transactional basis. Instead, Planet built hundreds of medium resolution satellites that took millions of images each day, then sold each image an unlimited number of times via subscriptions. In doing so, Planet built out two revolutionary capabilities: global scale and a time-axis for EO data.

These two capabilities are intriguing because:

1. They are uniquely complementary.

2. They have never been accomplished.

3. They enable precise measurement of human activity on Earth.

What is Planet’s competitive advantage (“moat”)?

Planet’s innovative approach to satellite development created a significant competitive advantage, which compounds with every day competitors lack a comparable constellation.

First, it’s important to understand the scale of Planet’s 200-satellite constellation imaging over 300 million square kilometers daily. Maxar, the largest commercial EO firm, operates four satellites covering 3.8 million square kilometers each day. Satellogic, an earlier-stage firm with similar aspirations to Planet, operates 26 satellites covering 7.8 million square kilometers per day. BlackSky, a government-oriented operator, has 14 satellites covering ~29k square kilometers. Airbus operates 16 satellites that collectively cover the Earth every 26 days. Planet covers more than 40x the area of its closest competitor daily.

What would it take to build a constellation with similar capabilities to Planet?

Quite a lot. It does not only require coverage of the entire Earth landmass; the constellation must produce a uniform data series from the imagery. In practice, this means the image must be taken at the same angle, at the same time of day, covering the same area, every day. Obtaining the raw imagery is just the first step, however, as the data must then be processed and stored for machine learning. It is a formidable technological feat that took Planet six years to tackle with a singular focus.

A recent McKinsey report supports the assertion that building a commercial constellation is immensely difficult. Despite a significant increase in the number of commercial constellations announced, execution has been lacking: 96% of constellations announced prior to 2019 have not reached their announced ambition, while 65% have either not launched a single satellite or canceled their plans.

Beyond the technological hurdle, any attempt to replicate Planet’s constellation will require access to a significant amount of capital. Amid the growing uncertainty in capital markets, this is a meaningful obstacle.

Now that we understand the basic difficulty of replicating Planet’s constellation, let’s look at the compounding effect this unique capability enables.

As the first mover, Planet can build software on top of its proprietary dataset to address new use cases. Thus far, commercial use cases are mostly limited to industries with geospatial data expertise (agriculture, forestry, mapping). While competitors work to obtain the requisite scale of data gathering, Planet can focus on the monumental technological hurdle of layering its data with object recognition and predictive analytics algorithms to expand the addressable market. By the time any competitors launch a fully-functioning constellation (at the bare minimum 3+ years by many estimates), Planet will likely have developed functional analytics to address a variety of industry use cases, contributing to the sustainability of its moat.

In addition, Planet maintains an irreplicable archive of 2,000+ images of every point on Earth’s landmass, training data essential to machine learning models. While competitors are gathering the requisite training data, Planet will be years into developing its analytics.

How does this moat translate into financial returns?

Planet’s business model provides greater revenue visibility and improved unit economics at scale.

Planet licenses each image in its database to an unlimited number of customers, creating a highly scalable platform with minimal incremental costs of revenue. 93% of revenue is recurring, with an average contract length of ~2 years.

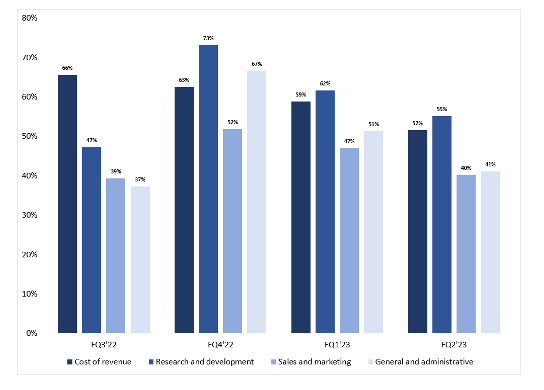

The below graph plots each category of expense as a percentage of revenue.

Across the board, there are clear declines in cost of revenue with evidence of substantial operating leverage. What drives this?

It all comes down to revenue growth. Planet’s constellations image the Earth every day regardless of sales, so incremental revenue comes with near 100% direct margins. Thus, I expect steady-state gross margins to be in the typical software range of 70-80% (from ~48% today).

Management has frequently cited a lack of capital as the primary constraint to growth. By going public, management received this sought-after capital and responded with tremendous execution.

Revenue growth accelerated meaningfully since going public, and management has increased revenue guidance on the last two earnings calls, implying continued momentum (Planet has also exceeded analyst sales estimates in every quarter).

Furthermore, management’s execution can be measured from the projections in the initial SPAC presentation (July 2021). Planet exceeded the projections for FY 2022 and FY 2023 remains within the stated guidance range. If the current outperformance continues, it should exceed ambitious projections intended to justify a $2.8 billion SPAC valuation.

To maintain accelerating growth, Planet must solve additional use cases while continuing to serve existing customers in new ways. Its record in this department is strong, as evidenced by consistent growth in customer count and net dollar retention rate (“NDRR”).

Planet’s customer count has exhibited a 26% 3-year CAGR.

Net dollar retention rate functions as a gauge of Planet’s success in extracting additional value from customers and reached 125% in FQ2’23. Importantly, this metric is calculated based on the annual contract value (“ACV”) at the start of the fiscal year, while most companies report it on a Y/Y basis. By comparing the NDRR in Q2 of last year to the Q4 result last year (the basis for this year’s reported number), we can calculate a more comparable metric. This approach implies a NDRR of ~150%, putting Planet in the same league as several hypergrowth companies.

To close this section, I will explore the pricing power of Planet data. Let’s first look at agriculture. Agriculture contributes ~$12 trillion to the global economy each year and covers ~25% of the Earth’s land. Planet is the only firm capable of monitoring the entirety of this farmland, and the use of Planet’s data is proven to improve crop yields by 20-40%. Given the sheer scale of these numbers, I think it’s a reasonable inference that Planet remains far from capturing the full value of its agricultural data.

For governments, Planet is the only operator to offer a unique “tip and cue” service. The “tip” stems from daily, global coverage, which alerts governments to changes at its borders or in areas of interest. Once change is detected, Planet can “cue” a high-resolution satellite to determine the source of change with greater precision. Together, the constellations offer an unmatched value proposition for federal and civil governments.

Planet has yet to explore many commercial markets, but the measurable impact of its data for current customers provides a strong case for similar pricing power with future customers.

Management

Planet’s management exhibits several traits I hold in high regard.

- Passionate founders: Will Marshall (CEO) and Robbie Schingler (Chief Strategy Officer) founded the company in 2010, and collectively exude passion for the mission.

- Alignment: Will Marshall has a 9.0% ownership stake, and Robbie Schingler holds 8.2% ownership.

- Competence: Planet’s founders have revolutionized the industry and built a one-of-a-kind platform. The two have decades of experience and have proven their competence through historical execution.

- Transparency: After the business combination, Planet reported earnings for FQ3 2022, even though it was not mandated to do so. Although not a critical data point, it’s a positive sign of management’s engagement with investors.

The primary takeaway: management is passionate, capable operators focused on the long-term opportunity.

Valuation

Despite Planet’s strong results, the market is unsure about the stock. The valuation peaked at ~25x sales on Planet’s first day of trading in December 2021. From there, the stock price promptly marched from $11+ to the $5-6 range, where it lies today. After the most recent earnings announcement, the stock shot up 20%+ before giving back its gains over the past few weeks.

I believe DCF analyses are a somewhat futile exercise when valuing unprofitable, disruptive firms. We can, however, use a multiple approach to arrive at a short-hand valuation. Planet is trading at ~5x EV / sales and ~16x EV / gross profit. I believe this is reasonable for a founder-led, disruptive company with an expanding moat, accelerating revenue growth, and improving margins.

Risks

- Cash burn: Planet will remain unprofitable while it ramps investments in software and sales headcount over the next few years.

o Planet has ~$458 million in net cash versus a ~$25 million burn rate in the recent quarter. Management commentary indicates they have ample capital for growth.

- Satellite underperformance: Planet’s satellites may deteriorate faster than anticipated, leaving holes in the dataset.

o Planet has launched 450+ satellites (multiples of any competitor), which provides comfort around its capabilities. It has also built redundancy into the constellation, preventing any underperforming satellites from impacting the dataset.

- Geopolitical risk: Countries such as Russia, China, Iran, etc. may not allow Planet to image their territory.

o International law declares anything beyond 100 kilometers altitude free space and affords protection to any satellite imaging the area.

Conclusion

Planet is in the early stages of transforming the EO industry. Rarely do industries experience the magnitude of change in performance capability that Planet has achieved without a corresponding change in market growth or market share. As the market comes to appreciate the possibilities enabled by Planet’s data, I believe investors will be handsomely rewarded over a 5+ year time frame.