Long DraftKings (DKNG)

Is the cash-burning online sportsbook investable?

“The beauty of sports is that you already start with a great product. It’s the world’s greatest reality show. We don’t have to create the content. It’s already there.“

- DraftKings CEO Jason Robins, 2014

If you watch sports on American broadcasting, you’ve probably heard of DraftKings. Their online sportsbook, which handles billions in wagers monthly, has been growing rapidly over the past several years. They listed on the NASDAQ via SPAC in mid-2019, and have since experienced a dramatic rise and fall in valuation similar to their fellow SPAC-listed growth companies. After declining 75% since peak valuation of $30B in early 2021, the company has lost its place in the spotlight—and many investors are wondering if the betting stock is now worth a gamble.

DraftKings

DraftKings was founded in 2012 as an operator of “daily fantasy contests,” which are pools that allow wagering through a clause exempting fantasy leagues from betting bans. In other words, gambling by proxy. This savvy business model—along with the company’s hyper-focus on growth—attracted over 8 million users to the platform by the end of 2016.

Everything changed when the US Supreme Court struck down the federal ban on online sportsbetting in 2018. DraftKings immediately made clear their pivot to operating an online sportsbook by launching widespread advertising campaigns in every state which allowed them.

Since then, they have not let up one bit on their ambition of growing their sportsbook as quickly as possible. If you consume sports-related media in the US or Canada, these efforts have been hard to miss—DraftKings has official partnerships with every major American sports league, ESPN and Fox Sports, and physical locations like Madison Square Garden and Crypto.com Arena in Los Angeles.

These efforts have undoubtedly paid off in some respect—as of mid-2022, DraftKings holds an estimated 25% share of the betting market in the US. However, attaining this substantial presence has cost the company billions of dollars in advertising and promotional giveaways. With interest rates rising, and the priorities of public companies shifting back towards profitability, DraftKings must toe the line between continuing to grow and demonstrating their ability to be FCF positive.

Financials

As you might expect, they have not yet delivered on the latter.

In 2021, DraftKings generated $1.3B Revenue, up 111% YoY. Despite this tremendous growth, their net loss increased to ($1.5B) from ($1.2B) the year prior. This was largely due to their massive $1B Sales and Marketing spend, up 98% YoY, and an outsized $680M in Stock-Based Compensation. After adding back SBC and other non-cash expenses, they netted ($420M) in Cash Flow from Operations. Along with ($200M) Cash Flow from Investing and $1.25B Cash Flow from an Issuance of Convertible Notes, the company’s change in Cash & Equivalents was $525M, for a year-end total of $2.1B.

In 1H 2022, they generated $880M Revenue, up 45% YoY, and are guiding $2.1B for FY2022. They also are guiding for ($800M) in Adj. EBITDA for the year.

Despite burning through nearly half a billion in cash last year, CEO Jason Robins assured investors in June that DraftKings will “get profitable on the current capital [they] have.”

With $2.1B in cash on hand, there’s enough dry powder to keep spending on customer acquisition for the next year or two, even if California and Florida enter the market. And assuming that the 2024 EBITDA-positive target is met, it’s hard to imagine that Robins’ assertion will be disproven. What, though, can we expect the financial future for DraftKings to look like?

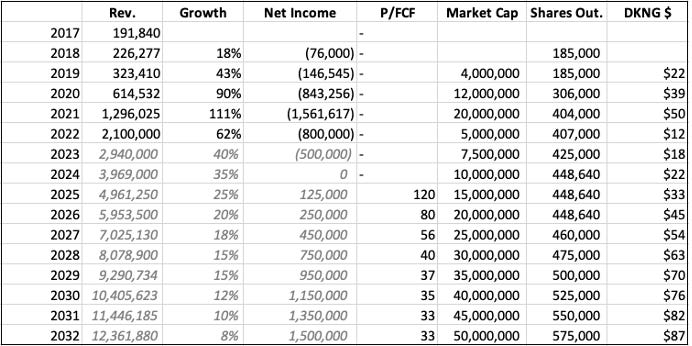

I've modeled DraftKings’ future earnings in alignment with analyst estimates, company guidance, and online sports betting market sizing forecasts. I’ve also consulted the equity incentive plan to predict the number of additional shares that will be issued for compensation through 2027. This model is obviously highly sensitive to the rate of sales growth and ability to improve margins, so any disruption to either could substantially change the 2032 target and thus present value.

With that said, A $87 price target for the stock in 2032 equates to a 19% IRR from today’s price of $15.14.

Bull

The biggest edge DraftKings may ultimately have is a popularity with casual bettors. CEO Jason Robins says that a main priority of the book is to limit sharps—bettors who use sophisticated data to try to win over the long-term—and attract the bettor simply looking to enhance their viewing experience. For example, their pre-packaged “Same-Game Parlays,” like Howard Ratner’s Uncut Gems wager, offer sub-par expected value—but are uniquely exciting.

[W]e're seeing great success driving parlay mix in our sportsbook product. In fact, our parlay bet mix increased by 1,700 basis points in the quarter compared to Q2 of 2021… Enhancing our parlay offering has been a top priority.

- CEO Jason Robins, Q2 2022 Earnings Call

Aside from this laser-focus on attracting the casual sports bettor, DraftKings is unique due to its advantageous market share, $2.1B cash pile, and a unabashedly aggressive management team. Just take this tweet from Founder-CEO Jason Robins as an encapsulation of the team’s tireless ambitions.

This blunt messaging will rightly scare some investors away, but one has to appreciate the willingness to show brazen desire to prove doubters wrong. In such a competitive industry, I would rather a management team be brash than too diplomatic. And to allay the concern about this being indicative of a toxic work environment, consider DraftKings’ 4.3/5 rating from employees on Indeed—above Fanduel’s 3.8 and MGM’s 3.9.

Team and strategy aside, though, an investment is a bet on a few factors:

The continuing legalization of online betting across the US

DraftKings’ continued ability to acquire market share at consistent cost through ad-spend and promotional deals in new markets

The ability of management to transition to profitability after this phase of customer acquisition

Of these, the uncertainty surrounding profitability is the most concerning. However, the company’s goal of 3-year timelines between launch and profitability on a state-by-state basis has held true so far—with 10 states forecasted to be cash-flow positive by the end of this year. Barring a change to the current trends surrounding DraftKings’ growth, the thesis behind investment will play out.

Additionally, as more states legalize online gambling and DraftKings’ userbase continues to grow, three key efficiencies will emerge.

National Advertising will become more efficient than regional spend, which will in turn reduce the incremental spend required in each new state.

Social Features will strengthen the network effect on the platform, making users less likely to switch. CEO Jason Robins says that “engagement has been very encouraging,“ and that they're investing in them as a key differentiator.

High-Level Data Analysis will become more and more useful as more users are added to the platform, allowing targeted promotions to be more accurate and effective.

Along with cutting costs, these efficiencies will allow DraftKings to drive margins higher in the coming years.

Why, though, is DraftKings’ stock price so depressed, even with all of these positive indications of future success?

Bear

It may appear that future growth is an inevitability for DraftKings given their short but impressive track record. However, there are a few key headwinds that could adversely affect this:

Monetary Tightening could decrease discretionary spending by consumers, including money spent gambling online.

Political Uncertainty in the three biggest U.S. states (California, Texas, Florida) could stall accessibility to over 25% of the potential domestic market.

New Market Entrants could eat into DraftKings’ market share, impacting their projected rate of growth

Considering the economic conditions in the US presently, any of these three factors could hinder DraftKings’ growth in the coming years. Even if these concerns are resolved, though, DraftKings will still be faced with its most important obstacle.

Cost

As DraftKings has grown their revenue, their costs have shot up with similar vigor. Not only is acquiring customers pricey ($371), but so is keeping them hooked with frequent bonuses and incentives. As costs are reined in, bettors may switch to other platforms with more generous perks.

California and Florida are both potentially going to join the market in the next 1-2 years. Acquiring customers in these states would likely cost DraftKings near $1B. Along with continued spend in other areas and new markets, it’s likely that the next 2 years will be extremely expensive for the company. And though Jason Robins has stated that the company’s plans to continue aggressively spending through this period, this will likely rely on established states becoming generative to support outsized spending.

Thus, any missteps in their profitability timeline could force DraftKings to either:

Cut ad spend and promotions to preserve capital—allowing other sportsbooks with deeper pockets to capture market share.

Raise capital through debt in a high-rate environment, OR equity at a depressed valuation.

Lastly, SEC information seems to contradict management’s bullishness. Though a few purchases have been made, insiders sold net over 15 million shares in 2022 so far. This begs the question: if management is so bullish on stock price, why are insiders selling shares after their value has fallen so far? Surely these 8-figure transactions are more telling about management’s outlook than tweets and interviews. And though profit-taking isn’t uncommon in newly-listed growth companies, it should give prospective shareholders pause given that management has been so outwardly optimistic on stock performance.

Verdict

I think the current valuation reflects the future prospects of DraftKings accurately, with the potential for market-beating returns as long as the current growth continues and the company is able to drive profitability as most anticipate them to. The only reason I wouldn’t call it a slam-dunk from a fundamental perspective is the uncertainty of running a loss for years on end in a competitive online market. However, I nonetheless have a position in this stock that I’ll be adding to if the price drops in the future, and here’s why:

Within the past two years, I've noticed that sports betting has appeared out of almost nowhere and exploded in popularity among 16–20-year-olds. Taking into account that my friends are mostly sports fans and thus my personal circle isn’t representative of the population, I would estimate that 5% of 16-20 year-olds, or over 1 million Americans, gamble monthly on sports (no official numbers on this, but this study seems to corroborate). The catch? All of this is being done on illicit sportsbooks. Whether it’s an overseas book like Bovada or a local bookie doing cash transactions, all of this betting is occurring without being accounted for in official statistics. This means that there is a sizable cohort of people who will immediately become frequent users of legitimate sportsbooks as they turn 21 (there is no reason to believe that illicit sportsbooks will compete with the likes of DraftKings; the latter offer easier depositing, withdrawal, promotions, and customer support). And this new generation of sports bettors have the profile that DraftKings loves; bets for fun to enhance the viewing experience, often places multi-legged parlays, and engages in betting as a social activity.

Because of this tailwind for user growth, along with my general optimism about American sports’ continued success, I recommend a long position at today’s price of $15.14.

Thank you for reading!

Toby Ford-Monroe

tqf2000@columbia.edu