Delta Apparel (NYSE American: DLA, $105mm market cap) is a vertically integrated micro-cap apparel manufacturer. Shares of the company have slipped -51% YTD (-49% in the last six months), and Delta now trades at <4x forward P/E. At this multiple, the company is valued as an undifferentiated legacy business facing a significant drop-off in consumer demand and continued gross margin contraction.

The market lumps Delta Apparel into a bucket of consumer discretionary stocks that had a one-time benefit from COVID. However, the reality is that the company’s normalized earnings power is significantly higher than its current levels. The company’s current valuation does not reflect the business’ bright growth prospects and longer-term shift away from basic apparel to higher growth, higher margin segments with higher ROIC profiles:

DTG2Go, an on-demand, digital garment printing business that recently onboarded its largest customer ever, sporting apparel e-retailer Fanatics.

Salt Life, a lifestyle brand with a long growth runway in terms of new branded units and expansion beyond the Southeast US.

This is a manufacturer with sustainable double-digit EPS growth rates long-term with strong moats relative to the industry around its growth segments, DTG2Go and Salt Life. At a minimum, it deserves to trade at industry multiples (~8x forward earnings). I believe the fair value for Delta Apparel shares is at least ~$35/share, representing more than 2x from the current price.

Company Overview

Delta Apparel reports two separate segments: Delta Group and Salt Life. The high potential DTG2Go business is embedded within the Delta Group. A quick summary of each business is below:

Delta Activewear (~75% of revenues): A “preferred supplier of activewear apparel to regional and global brands, direct to retail and through wholesale.” Customers include retail giants like Walmart, Target, outdoor/sporting goods retailers, and brands such as Callaway Golf.

The manufacturing footprint is entirely in North America (US and Central America) with a diversified customer base as no single customer makes up more than 10% of sales. Historically, this has been a stable (boring) business. However, as more customers look at near-shoring operations in the future, Delta is well positioned to benefit from that trend.

DTG2Go (~14% of Sales): A market leader in on-demand, direct-to-garment digital print, and fulfillment that can deliver custom graphic products to customers in the US within 24 to 48 hours. DTG2Go explains that they “use highly-automated factory processes and our proprietary software to deliver on-demand, digitally printed apparel direct to consumers on behalf of our customer.”

So why are these capabilities important? On-demand garment printing allows retailers to reduce the need to carry a lot of physical inventory while offering even more variety than a traditional supply chain by leveraging a ‘virtual inventory’ of SKU’s. DTG2Go has forged strategic partnerships with retailers like Hot Topic and Fanatics, integrating their systems within the customer distribution centers. More of these types of arrangements are expected in the future.

DTG2Go is the number two player in this space, behind only Merch by Amazon (which is not vertically integrated, and brands would be hesitant to share data with them). Other competitors include platforms like Printful, which are geared toward single orders and not large-scale operations.

Delta first entered this business via acquisition in 2009, growing it from no revenues to ~$60mm. It would be challenging for a competitor to replicate DTG2Go’s capabilities given Delta’s vertical integration, decades of manufacturing/process excellence, and supply chain that leverages Delta Activewear’s distribution network and inventory of blank T-shirts.

Salt Life (~11% of sales): An aspirational lifestyle brand with a strong brand presence in the Southeast, rapidly expanding in e-commerce and retail (expected to triple branded retail store count in five years). You may have seen one of the over 2 million ‘Salt Life’ decals on cars all over the country.

At ~$60 million in revenues for FY22, there is a very long runway for the brand as it expands outside the Southeast into any ocean/beach market across the country. Revenues are still a fraction of lifestyle brands such as Tommy Bahama ($670mm+ pre-COVID) or Vineyard Vines (est. ~$500mm). Not only is the TAM large, but the brand also has great unit economics across channels. On average, new physical branded units cost $550k to build out (including inventory) with $800k annual unit revenue. Top stores are doing over $1.5mm in sales at 30% operating margins. E-commerce operating margins are more than double the operating margins of Delta Apparel as a whole.

Growth Outlook and Profitability by Segment

Why does this opportunity exist?

· The company was removed from the Russell 2000 Index in 2021

· Only 1 analyst covers the company via sponsored research

· Lack of consistent disclosure of DTG2Go financials, making it difficult for the market to place a multiple on this high-growth, high-margin business

Key Thesis Points / What the Market Is Missing

Despite apparel being a COVID beneficiary, Delta Apparel’s normalized earnings power is much higher than the market is currently pricing in.

1) Even with unprecedented cotton inflation during the year, DLA will finish FY22 with its highest operating margins in over a decade (and the worst gross margin contraction will be behind them in FY23).

Cotton prices have already corrected and are back down to mid-2018 levels at ~$90/lb, down from a high of nearly $160 in the back half of 2021.

2) New investments in the DTG2Go business and ramp-up with Fanatics temporarily depressed earnings in FY22 (” breakeven operating margin” per CEO), but this business will return to mid-double digit operating margins in FY23.

In a mid-August conference geared toward retail investors, CEO Bob Humphreys said:

“Our DTG2Go business had operating margins in the mid-to high teens a couple of years ago. We’ve been reequipping that business with some new technology, so it’s brought that down considerably to about a breakeven operating margin as we work through that. But now we’re past the investment, and we’re building production and building productivity. And we’ll have our best revenue quarter this quarter ever in DTG2Go for the September quarter, and we’re starting to see the fruits of our work in that business and expect it to return to mid- to high double-digit -- our team operating margins.”

Furthermore, Humphreys told me during a call after recent Q3 earnings that DTG2Go can improve throughput by 30-35% without any additional capital expenditures this year.

3) Long term: As Delta continues to drive growth in its emerging segments, it will significantly benefit from a favorable business mix change and more robust competitive advantages over time.

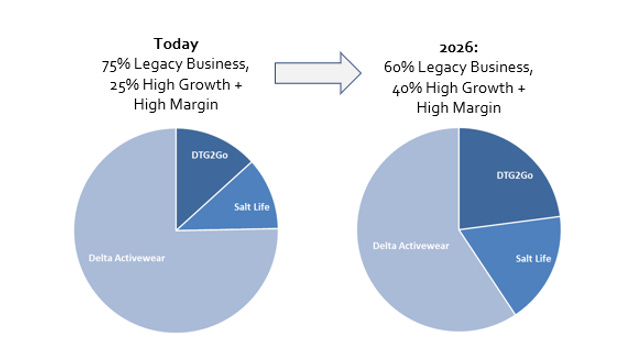

DTG2Go and Salt Life are margin accretive segments with a long runway of reinvestment opportunities that make up ~25% of revenues today but should reach around ~40% of revenues by FY26 given current guidance.

4) Salt Life is worth $10+/share on its own and could be spun off if the company cannot realize the value of this fast-growing brand.

Salt Life should do around ~$10mm in EBITDA in FY22. Delta has increased its branded store count from 13 to 20 during the year while YTD revenues are +22% vs a strong FY21. Assuming a ~7x EV/EBIDTA multiple (see: Oxford Industries, NYSE: OXM), it is not crazy to assert that Salt Life on its own is worth $70mm or about $10/share. Management has stated in the past that if they cannot realize the value of this brand, it could be spun off (hence why they report this segment separately).

Valuation

My price target for the company is $35/share, assuming a 8x P/E multiple on an FY23 EPS estimate of $4.59. Comparable companies include Gildan (NYSE: GIL) at ~9x forward earnings and Hanesbrands (NYSE: HBI) at 8x.

For FY23, I assume:

No additional share buybacks (conservative given -2% share count CAGR in last five years)

DTG2Go at 15% operating margins, bringing total Operating Income margins to 8.8% (up ~80 bps from FY22)

Modest 2.5% growth in Delta Activewear and 20% growth in Salt Life with an additional 6 retail locations

I do believe that the company’s true intrinsic value is much higher than $35/share. As a standalone business, Salt Life itself should be valued at ~$10/share. Furthermore, one could argue that DTG2Go deserves a higher standalone multiple given its proprietary technology/process, 15%+ annual growth at ~20%+ EBITDA margins long-term. If management can improve disclosures around DTG2Go, it could help unlock value. My price target does not assume this happening.

Investment Risks

A slowdown in consumer demand: Delta should be somewhat insulated from a major pullback in consumer discretionary spending given that basic apparel are not big ticket items and perhaps the most ‘essential’ out of all clothing categories. Even during the GFC, Delta Apparel was able to grow sales +3% in FY08, +10% in FY09, and +20% in FY10.

Irrational pricing environment: With cotton prices receding, will competitors slash prices to pick up volume, or will they try to maintain more of the price increases that have been passed through in the past two years?

Short Term Catalysts

Large holders stop selling out: With an average daily trading volume of <$500k, it is not difficult to move the stock, and a couple of larger shareholders (and 13F filers) have been reducing their positions through Q2 (and likely in Q3).

Upside surprise in Q4: Expectations from the one analyst covering the name are extremely low (Sales +7 YoY, Operating Profit -10%, Net Income -14%). The fourth quarter, which ends in September, is the first year with the new Fanatics business that is most active in the fall given the start of college football season.

Great pitch, especially working to talk directly with the company to understand certain key drivers and absolutely deserving of the win.

Given DTG2Go is currently at breakeven despite management claims since the acquisition that it would be a high margin addon, can the statements of forward margins on the business be trusted?

Your model assumes fiscal 2022 and 2023 will have operating margins of 8%+. TTM operating margins are currently at 7.5%, are you expecting a large upside surprise in Q4 from the Fanatics business?

Also on margins, inventory is up over $10 per share in the past year and well past historical levels, will the likelihood of discounting depress margins? I would assume one of the reasons the stock has sold off so much is because forward earnings are likely lower than trailing, when combined with the increasing debt the stock isn't as inexpensive as it initially appears. Thanks!