Celsius is a fitness drink that has been clinically proven to accelerate metabolism and burn calories and body fat while providing healthy energy. Celsius energy drinks were created in 2004 and the business was reversed merged into the current company in 2007. Celsius is a healthier, lighter, and more refreshing energy drink that is built around their proprietary “Meta Plus” blend which includes natural ingredients such as guarana extract, green tea leaf extract, ginger root extract, taurine, and of course caffeine. Drinking prior to fitness activities is proven to energize, accelerate metabolism, and burn body fat and calories. Research state’s that Celsius has thermogenic properties which help make it one of the most advanced energy drinks on the market, separating itself from peers such as Monster, Red Bull, and Rockstar. Thermogenic properties are proven to increase metabolism and make the nervous system more active. This will make your body burn more calories and more fat than you normally would. This makes the drink appealing to athletes of all sort and regular everyday people looking for a healthier alternative to mainstream energy drinks or coffee. Many scientific studies have been recorded and you can find them here https://www.celsius.com/the-science/

Celsius does the developing, marketing and distribution of their beverage in the United States and internationally across Europe and Asia. To expand they have created many different flavors and offer carbonated and non-carbonated options. The company distributes their products through direct store delivery distributors and can find this product in almost all drug stores, nutritional shops, health clubs, and supermarkets.

Celsius has expanded and created a unique product portfolio that includes categories for almost all types of consumers. They currently market the Celsius Original, Celsius Sweetened with stevia, Celsius On – The – GO, Celsius Heat, and Celsius BCAA + Energy. Celsius blows away all other energy drinks in taste and all the added health benefits. Energy drinks have always had a bad reputation and I believe Celsius is the only product on the market that can change that way of thinking in consumer’s mind.

Business Strategy:

“Were scaling Rapidly” Celsius Energy Drinks CEO to streamline Logistics after receiving a $550 Million dollar investment from PepsiCo. The cash proceeds will help strengthen the balance sheet position and fund ongoing growth initiatives. Distribution agreement is expected to add significant topline scale and accelerate growth and substantial margin accretion expected from leveraging PepsiCo’s leading DSD network to rapidly scale the business. Celsius expects to integrate over 200 of its independent U.S distributors with PepsiCo network and seeks to further decentralize warehouse to be closer to its co manufacturers in the face of inflationary and supply chain constraints, CEO John Fieldly stated. Securing this $550 million investment from Pepsi along with a long-term distribution partnership with Gatorade is massive. This will allow them to increase their global footprint by 40% and better target college campuses. As A Division 1 athlete myself and college student, I see people drinking Celsius in all my classes and many of my teammates drink them before games, practice, and workouts. Celsius has faced some challenged due to the economic environment such as high shipping cost but have been still able to produce stellar earnings while the stock trades right under all-time highs. CEO has noted that they are scaling rapidly, “sales were up 135% for the second quarter, and have been able to offset some of the inflationary cost they have faced. The CEO continues to state and reaffirm that they will continue the formulation of products moving forward. This strategy has enabled them to outperform the $53.1 Billion global energy drinks market. This is notable as Celsius is ranked #2 on Amazon as the fastest growing energy drink brand in the country and that they truly are at the forefront of disrupting an entire business. One of the main reasons Pepsi acquired a stake in Celsius is because they are one of the only new functional energy products on the market targeting the younger population along with older people. Celsius is truly capturing the market for everyday fitness lifestyle drink. Celsius is expected to gain more shelf space in existing retailers and expand more into independent stores, such as gas stations. Pepsi will assist in this process and allow Celsius to continue gaining market share in the energy drink category which remains one of the fastest growing nonalcoholic beverage categories in the world.

Competitive Advantage:

Celsius is suited to take complete market domination of the energy drink market. With the $550 million dollar investment they have one of the largest American multination food and beverage corporation on their side betting on them and helping with their growth. The energy drink market is expected to reach $108.40 billion by 2031 growing at a CAGR of 8.2% from 2022 – 2031. I believe that CELH can capture 3% of this TAM and take market share from Monster and Red bull who have been the giants for the last decade. Celsius will be able to do this through providing a healthier, higher quality, more brand awareness, more retailers, more distributors, and expanded shelf space with the roll out of their new coolers. Celsius is one of the first competitive companies to challenge these outdated and old companies. I believe that Celsius is on the path to reach nearly a $25 billion dollar market cap in the next 5-10 years and that would put them as the leader in the space. Since inception, Monster ($MNST) has returned an astonishing 67,107.69% return to investors since IPO in 2003. Pepsi ($PEP) has also returned investors 6,643.09% since IPO in 1999. Lastly, Coke ($KO) has returned investors 6,986.90% since IPO. Although Celsius is not a business that is coming out with a revolutionary product or device, they are entering a market that is growing rapidly and one where they become the clear leader if they continue delivering.

Growth Strategy / Retailers

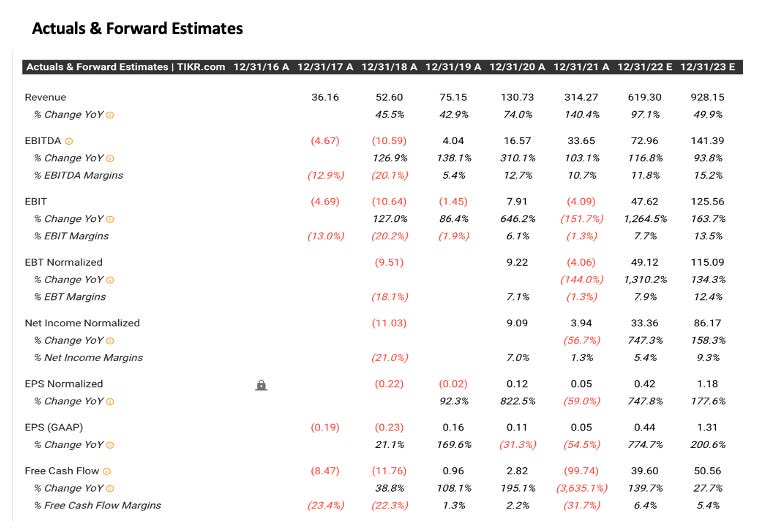

Celsius is currently authorized in more than 82,000 locations and is expected to continue growing. They are also now in approximately 7,000 grocery stores nationwide. You can find Celsius at Walmart, Target, CVS, Vitamin Shoppe, GNS, 7- Eleven, Dick’s sporting goods, Kroger, The Fresh Market, Sprouts, HEB, Publix, Winn Dixie, Harris Teeter, Shaw’s, Food Lion, Speedway, and many more. Celsius is currently growing 11x faster than peers and as of Q3 2022, earnings have grown 81.82% YOY and is 63.79 percentage points higher than the US Beverages – Non-Alcoholic industry earnings growth rate of 18.03%. Revenue of $154 million, up 137% from $65.1 million in Q2 2021.

Valuation

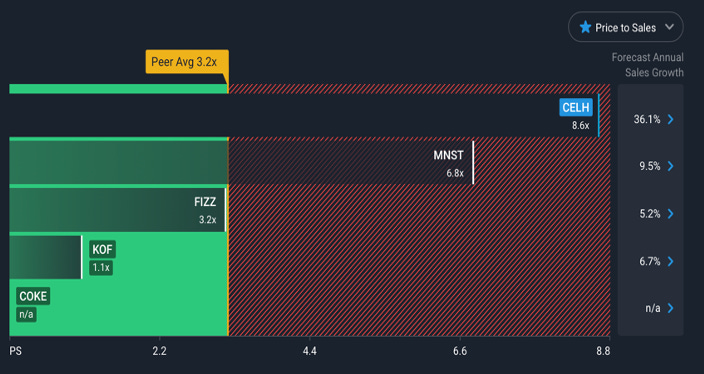

Celsius currently trades at a 14x P/S (Price to Sales Ratio) and has a MC of $6.79 Billion and sales of roughly $486 million. The P/E price to earnings ratio is relatively high, but I would not view that as a red flag. Most of the leading stocks to ever make historically runs were trading at extremely high P/E ratios. CELH currently has a P/E ratio of 369.1 which is relatively high. Price to book ratio lies at 28.3x and has the other following ratios

- Enterprise Value/ Revenue 13.8x

- Enterprise Value/ EBITDA 359x

- PEG Ratio of 6.7x

Forward P/S Ratio Versus Peers

Future Growth

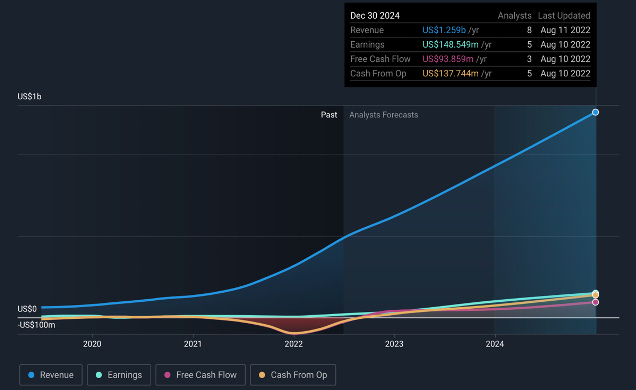

Based on models and projections, Celsius is forecasted to have 55% annual earnings growth. By December of 2024, they are expected to do roughly $1.259 Billion in revenue a year with earnings being $148.54 million a year. Free cash flow of $50.57 million.

Celsius is projected to report EPS of $1.97 by December 2024 and then expected to grow even more to $2.7 EPS by December of 2025. This is fantastic growth that you need to see as a growth investor and Celsius has been constantly hitting their numbers and I see no reason why they will not stop hitting their numbers. Another highlight as an investor is the ROE, (Return on Equity) they are projected to have a future ROE of 30% over the next 3 years while the industry average is only 16%. Celsius is in a good financial standing having adequate cash on hand, assets, and low liabilities on their balance sheet. They currently have $303.7 Million in short term assets and $105.8 Million in short term liabilities. Long term liabilities are $3.9 million. CELH is debt free and does not need to cover any debt from operating cash flow and coverage of any interest payments is of no concern.

Management

Celsius is led by CEO John Fieldly who has an extensive consumer goods background. John has over 20 years of financial and operation experience. Prior to being CEO, he served as the CFO of the company since 2012. John has demonstrated a proven track record of driving business results and increasing shareholder value. He can leverage his strong background in finance and accounting to focus on maximizing resources to drive revenue, corporate effectiveness, and most importantly, increase shareholder value. Other notable management is Jarrod Langhans CFO with 20 years of experience, Marcus Sandifer VP of Business and Legal Affairs, Kyle Watson VP, Marketing, and Tony Guilfoyle EVP Sales. This is a strong management team with no red flags that I have come across. Lots of experience and motivation to create a monopoly in the energy drink space.

Analyst Ratings

UBS – Strong Buy

Jefferies & CO. – Strong Buy

Maxim Group LLC – Strong Buy

Roth Capital – Strong Buy

Credit Suisse – Strong Buy

Bear Case

There is always an opposing view to every investment decision and always a buyer for every seller in each transaction. I have decided to present a few red flags that have popped up in my research and some things that could potentially defer people from investing in CELH. Many will argue that buying CELH right now makes no sense because it is up a whopping 1.455.50% over the last 5 years. Through my research, all the best investments and winning stocks were the ones showing explosive strength throughout the whole life cycle of the company. I see no reason to call CELH overvalued as I’ve explained that they are on track to more than double over the next decade. One red flag is that Celsius has had some problems with the SEC. They have made some errors with accounting, disclosures, and numerous typos in their filings. A very easy fix is to get a new auditor and I see no red flags in that procedure. Lastly, the largest Celsius shareholder is Carl DeSantis. He previously founded a vitamin company that had to pay $12 million to settle charges of misleading healthy claims with the FTC. Not many red flags in my opinion and it is impossible to ignore the explosive growth this company has shown over the past 5 years. If they can continue hitting numbers and growing, I have no doubt in my mind this will be a fantastic investment for the next decade.

Bull Case

As stated throughout this report, I am extremely bullish on Celsius and believe this is an investment that will perform 10x over the next decade. In my opinion, I think this is one that you will regret not buying when looking back. Entering a growing Energy drink market that is expected to grow to $100 billion in the next 5-6 years and Celsius is at the forefront of this sector creating the best tasting, and healthiest energy drink backed by real science and studies completed on many individuals. This stock provides a ton of room for upside still being valued under $10 billion and having some of the most explosive sales, EPS, and ROE for a growth stock. In my most bullish scenario, CELH gets to $2.5 billion in sales in the next six years and would need to maintain a 50% annualized growth rate. If they can accomplish this then I would expect the market cap to be $25 billion in six years, somewhat optimistic but very possible in my opinion.