Executive Summary

Recommendation: Long

Name: Brookfield Asset Management

Ticker: BAM

Current Share Price: $42.18

Thesis: A true quality asset management company currently trading at a bargain multiple due to a complex corporate structure and macro headwinds of rising interest rates. We believe that BAM will nevertheless still provide above average returns due to its excellent management team and a short-term catalyst in the form of the spinoff of its fee earning Asset Management business.

Valuation: By combining valuation estimates of the fee-related earnings and carried interest of BAM’s asset management business with its invested capital, we have a 1y price target of $63.33 and a 5y price target of $134.75.

Business Overview:

Brookfield Asset Manager (BAM) is an alternative asset manager and owner, with $750bn AUM, of which $400bn is fee bearing capital. BAM invests across a broad portfolio of asset classes, mainly through its listed subsidiaries, named below.

- Renewable power and transition – BEP, (48% ownership)

- Infrastructure – BIP, (27% ownership)

- Private Equity – BBU, (67% ownership)

- Real Estate – BPG, (100% ownership, unlisted)

- Credit & Insurance solutions

In BAM’s recent investor day report, it has divided its business into 3 key pillars that will drive growth going forwards following the asset manager spinoff.

1. Asset Management Business – Investing capital on behalf of clients, in return for a long-term management fee as well as carried interest on successful investments.

2. Insurance Solutions – Providing capital-based solutions to insurance companies and their stakeholders, using expertise across Brookfield and Oaktree

(3) Capital Investment Business – BAM has approximately $67bn of invested capital on its balance sheets, invested mainly through it’s subsidiaries.

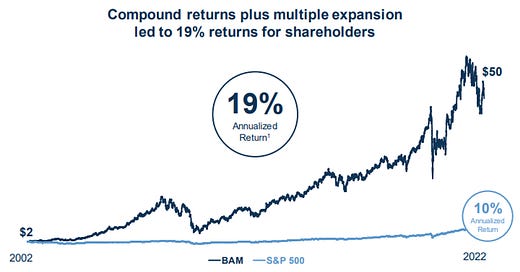

BAM has a great track record, delivering annualized returns of 19% over the last 20 years, demonstrating its ability to allocate capital at excellent returns. Purely by examining this history of returns, it is not unfeasible to imagine that this can continue well into the future.

Multiples:

At current market prices, BAM is trading at roughly 1.5x LTM book value and 11.9x NTM earnings, which is cheap compared to its main competitors Blackstone, which is trading at roughly 6.8x LTM book value and 17.6x NTM earnings. We believe that this is an extremely cheap price to initiate a position in BAM, given various tailwinds and growth aspects which will be described next.

Investment Thesis

Market view:

BAM is priced imperfectly because:

- BAM has a very diverse and complex corporate structure, due to various spin offs and subsidiaries, so the stock is poorly covered and misunderstood

- BAMs share price is down 32.28% YTD, largely due to multiple contraction, with the market pricing in the headwinds of rising interest rates. We believe that this is an overreaction and BAM will outperform its competitors in the coming years.

- Due to the inherent short-term view of the market, BAM is trading at a discount on a 5 to 10y basis. We believe that BAM’s established competitive advantages can sustain returns longer than market anticipates.

Our thesis boils down to 4 points:

1. BAM is a great business

2. The incoming asset manager spin off will align market price closer to intrinsic value

3. The headwind of rising interest rates is overstated

4. Tailwinds of increased demand for real assets

Why is BAM such a good business?

1. Management

We believe BAM has one of the strongest management teams on the planet. This is most easily shown by their CEO, Bruce Flatt. Dubbed the ‘Warren Buffet of Canada’, Flatt joined Brookfield in 1990 and was appointed CEO in 2002. He has guided the company for 20 years, escaping the GFC relatively unscathed in comparison to its peers and has multiplied Brookfield’s value by over 20 times in his tenure. Flatt is only 50 and we believe while he still resides CEO of BAM, it will remain a strong business.

The majority of Bruce Flatts team joined at similar times. Brian Lawson joined the company in 1988 and became CFO in 2002. Brian Kingston, who is CEO of the real estate activities, joined in 2001. In this day and age, it is unusual to have a large group of managers with such a long tenure at a single company.

Furthermore, we believe BAM’s management are well aligned with shareholders, encouraged to “devote most of their financial resources to investing in Brookfield” and owning roughly 20% of the shares.

2. Moats/Competitive Advantages

BAM has a competitive advantage simply due its sheer size and global scale. For a typical asset management company, this could pose an issue, but due to its nature of investments (infrastructure, real estate), this benefits BAM. It gives BAM access to deals and opportunities that smaller asset managers may not be able to afford, allowing them to allocate capital to the most attractive investment area at any given time.

BAM AUM is made up of a large institutional investor base, which is only growing, raising $16bn over the last reporting year from 260 new institutional investors. Looking to the future, this investor base should only increase, as institutional clients look to private markets for results in turbulent times. This will create a long-term flow of fee revenue from sticky clients.

A third competitive advantage of BAM is the quality of its asset base, which we believe is set to perform better heading into the macro headwinds than its competitors. This is largely due to BAM’s concentration of its AUM in inflation-linked infrastructure and renewable power, which we believe will perform better than more economically sensitive asset classes, such as private equity. Infrastructure and renewables make up $205bn of BAMs AUM, or around 27%. Furthermore, roughly 70% of BAM’s renewables portfolio has contracts indexed to inflation, while its Infrastructure business has about 70% of its funds from operation (FFO) with contractual or regulated adjustments for inflation. In comparison, Blackrock, BAMs main competitor, only has around 3% of AUM in infrastructure and renewables.

3. Financials

BAM has a conservatively capitalized balance sheet. They are soundly financed, with a debt to capitalization ratio of 13%, and have about $70bn cash and semi-liquid investments on hand. This gives BAM the ability to deploy capital whenever they identify investment opportunities.

The Spin Off

BAM has announced the spin off of 25% of its asset management business, before the end of 2022. Shareholders of BAM will receive one share of the “Manager” for every four shares of “Brookfield” (the stock currently trading under BAM). The spun-off stock will be called Brookfield Asset Management and trade under the symbol of BAM. The pre-existing stock, will then be called Brookfield Corporation and trade under the symbol BN. The Brookfield Corporation will retain 75% of the Manager.

We believe this is the catalyst Brookfield needs to align its current market value with its ‘plan value’ – leading to some strong multiple expansion and allowing shareholders to capture more of Brookfield’s returns in the next 5 years.

Interest rates

Although BAM does face headwinds of real interest rates, we believe that the impact of these is currently overstated in the market price. While interest rates look to head even higher in 2022, real interest rates remain negative. This provides a small tailwind for BAM, as negative real interest rates increase the replacement cost of alternative assets, which gives them a greater barrier to entry and greater pricing power. With BAM’s sizeable AUM, it will be able to take advantage of these opportunities, ensuring consistent cash flow.

Bruce Flatt, CEO, remains optimistic, saying at the recent investors day “I think everyone is projecting rates that are too high. But are business works great at today’s rates, especially with some inflation”.

Tailwinds to Real Assets

Institutional investors are looking towards real assets, more specifically infrastructure assets, due to their predictable cash flows and stable yields. Secular trends of increased demand for data infrastructure and deglobalization will also act as tailwinds to alternative asset managers. This slide from BAM’s recent investors day shows the growth of alternative assets and their projections for real asset allocation of institutional investors by 2030.

BAM also will benefit from tailwinds to its renewable power business as well, with decarbonization acting as catalyst for growth in the coming years. BAM is only devoting more capital to renewable power, acquiring a solar developer in Germany in 2022 Q1 and recently agreeing to acquire Standard Solar and Scout Clean Energy.

Valuation

In order to value Brookfield Asset Management, we will apply a multiple to the fee related earnings (FRE) and carried interest of its Asset Management franchise. We will then combine this with the invested capital on its balance sheet in order to find a total valuation.

As of Q2 2022:

- Fee-related earnings: $1,951 mn

- Carried interest: $2,415 mn

Although we feel that BAM will fare relatively well in the face of its macro headwinds, we will still use conservative valuations. Management has used a multiple range of 25 to 35x for FRE in its investor’s day, so we will opt for a 20x multiple. Applying a multiple of 20x to FRE and a 5x multiple to carried interest gives us a total valuation for its asset management business of $51.095bn.

As of Q2 2022, net invested capital is $51bn.

Summing these brings us to a total valuation of $102.095 billion.

Outstanding diluted shares is 1,638.1mn shares, which brings us to an implied share price and 1y price target of $63.33. Currently, BAM is trading at a price of $42.18, implying an upside of 47.7%.

Since we have recommended initiating a long position in BAM for an investment period of 5+ years, we will also calculate a rough 5y price target. BAM has allocated a value to its business, the “Plan Value”, at a range of $82-94 per share in 2022. In order to be conservative, we will use the low range of it’s estimates of Plan Value, or $82 per share. Our implied share price is $63.33, or 77% of Plan Value.

BAM has projected a Plan Value of $175-198 per share in 2027. Again, we will use the conservative end of their estimates, $175. Using our same methodology to value BAM in 2022 would give us an implied share price of $134.75, or 77% of 2027 plan value. Therefore, by holding both the Corporation and Manager shares, we can expect a rough 5y return of 219.46%.

Risks

Stock remains undervalued after Asset Manager spin-off

- Market price and “plan value” will never truly align, however this is not a huge risk

o As long as BAM’s management still manage to effectively allocate capital, we believe the market price will still reach our price target, albeit at a slower pace

Rising interest rates

- As in the investment thesis, while real interest rates are still negative, BAM will benefit from increased barriers to entry to alternative assets, due to its size and scale.

- Secondly, higher interest rates are likely to come with higher economic growth which is usually a tailwind to fundamental performance and valuations.